By Phil F. Aragbada

The startling revelation that the Federal Government spent N2.34trillion out of a total sum of N3.25 trillion accrued revenue in 2020 on debt servicing, to put it mildly, shows a potent recipe for economic bankruptcy.Expending over 72% of the annual National revenue on debt servicing in one year, if not checked, could drive the country to the webs of debt trap of both domestic and external lenders with a consequential and virulent economic depression.

For Nigeria to achieve socio-economic sanity and abundance, the governments at all levels must collaborate in the fight against banditry so as to ensure security to lives and property. With unprecedented unemployment rate of 33.2% coupled with hyper-inflation hovering at 17%, Nigeria has been grouped among the most miserable nations with 50% misery index thus positioning her at number six on the global misery index chart.

At over 100 million Nigerians languishing in abject poverty, purchasing power has diminished, thus incapacitating real investment yields. It should be realized that for business to grow and prosper, confidence building on the part of the authorities is sine qua non, as attracting foreign investors is a mutually symbiotic relationship.

Provision of electricity must be guaranteed in order to produce and make reasonable profits, which will in turn generate higher revenue for the government through taxation.

Availability of friendly- interest rates’ regime for all levels of businesses has no option for the economy to thrive. This kind of monetary policy regime has always been put in place in many countries during periods of economic stress.

The government should impose and enforce heavy import duties on luxury goods and minimum taxes on industrial and agricultural equipment to reduce cost of production and in turn generate higher returns for producers and by extension, better wages for workers which will reflect in enhanced purchasing power of consumers and improved standard of living for the generality of citizens through multiplier effect.

The government should also take deliberate steps to resuscitate the defunct textile Industry through soft loans in addition to embracing backward integration in their production process to make them more competitive. This will mitigate the country’s reliance on oil proceeds that normally expose the economy to the vagaries of external shocks.

In conclusion, the government should up the ante on its war against the hydra headed monster of corruption as no policy, no matter its structural and professional elegance, can work without extirpating the culture of dishonesty; while efforts should be geared towards privatizing the Nigerian National Petroleum Corporation (NNPC) and the refineries towards minimizing expenditure on imported fuel and by implication foreign exchange. All these expositions will boost the foreign reserves of the country.

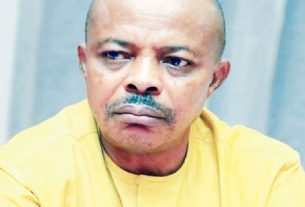

Aragbada is a former group Insight Editor/Editorial Board Member of the rested Sketch newspaper and retired deputy general manger of Cooperative/ Skye Bank Plc. He wrtes from Ibadan.

The Guardian